Everybody Loves Charts!

Every so often, I’ll check in to show items floating around Wall Street circles and blogs.

Longer term trends in the markets and economy.

Extra details on what seems underappreciated or overhyped.

Link to some great explainers on the concepts.

**Everything as of 5/31/2025

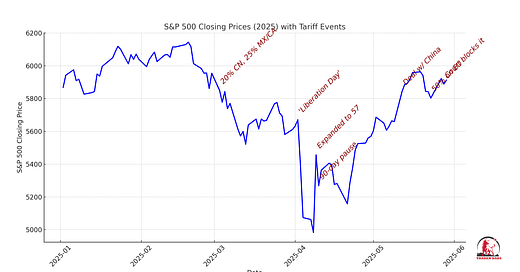

The S&P 500 just had its best May since 1990 and its best month since November 2023 with a gain of 6.2%. The Dow rose by 3.9% in May and The Nasdaq surged nearly 10%.

This sounds impressive until you consider SPX declined by 5.75% in March and another 0.7% in April 2025 (with a max drawdown of 17.6%)

So where does all that volatility leave us for the year? That Tower of Terror freefall and rebound trip left investors with nothing but whiplash, a higher VIX floor, and a measly 0.51% YTD return.

Pundits, research analysts and the public attribute the cause of the swings to the erratic tariff announcements from the White House and at first glance, it does seem that way. However, I’d argue any valuation model with some common sense and foresight could have sidestepped or withstood the dip saving a lot of the stress and possibly setting up some great low-risk buying opportunities.

Equity Model Sensitivities

If there is one original sin of market theory, it’s be the prevalence of the Efficient Market Hypothesis.

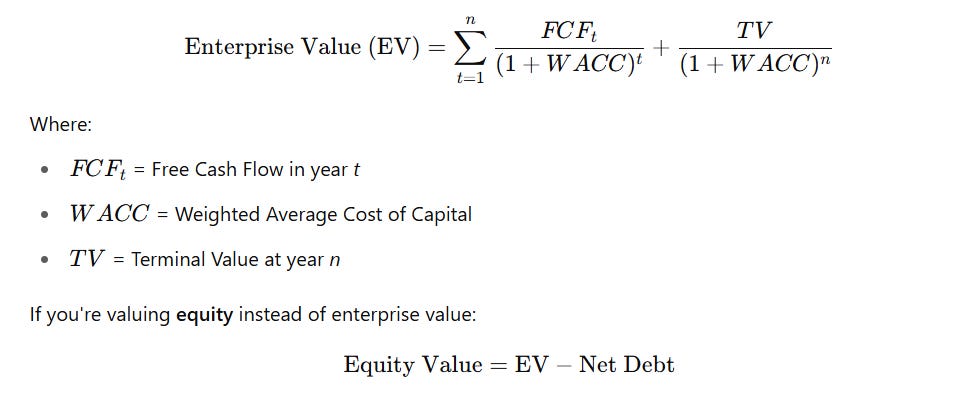

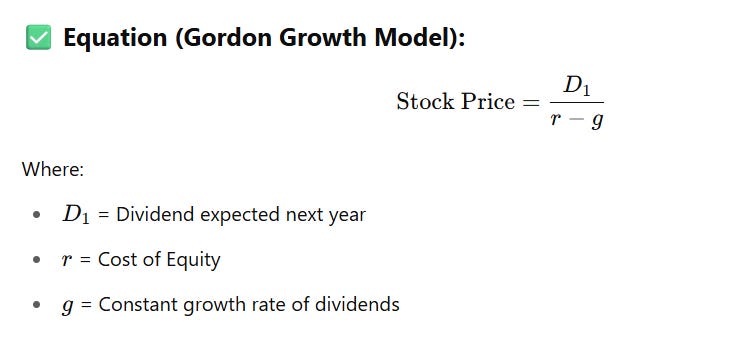

The foundational idea of the EMH is prices reflect all available information. This premise follows through to the two major equity pricing models: Discounted Cash Flows (DCF) and Dividend Discount Models (DDM) by instantly updating the inputs of the model with updated values and assumes this is how it will be going forward

Discounted Cash Flows-

Dividend Discount Model (Gordon Growth)-

In the case of Spring 2025 announcements, the assumption added to the models is tariff rates would essentially drain companies of cashflow due to either paying the tariff costs to the government or outright losing sales from the increased costs / supply crunches.

Therefore, numerator goes down→model price output goes down—>market makers lower their price to buy/sell

But does the model take sanity and politics into account? Absolutely not!

In the short run, the market is a voting machine but in the long run it is a weighing machine — Benjamin Graham

While this assumption results in excellent and accurate instantaneous pricing, the models fail to generalize to future market conditions, leading to inaccurate predictions and ultimately losses. In poker, this would be failing to consider the implied odds1 of playing the hand.

Is it reasonable to think tariffs were going to stay at +125% for very long?

Is it reasonable to think a deal would not be reached as soon as Billionaires' Row felt the pain in their portfolio holdings?

Is it reasonable to think some companies would figure out a workaround to recover their sales and margins?

All the drama to be precisely accurate in the moment failed to see the simple implied forecast that any policy action by a novice Economics and Trade team would be reversed or nullified soon enough

The result was a win for the buy and hold crowd and dip buyers and a lesson in rushing to fit a model too fast with “perfect” information.

Interested in being on the Trader Dads Podcast in 2025? Shoot me an email! I’d love to have subscribers on to sit for a discussion

TRADERDADS MAILBAG

Thoughts? Questions? Comments?

Reach out! Maybe I’ll do a full post on the topic or as a Q&A

traderdads@substack.com

Implied odds in poker refer to the additional money a player anticipates winning from future bets if they complete their hand, even if the pot odds are not currently favorable.