Everybody Loves Charts!

Every so often, I’ll check in to show items floating around Wall Street circles and blogs.

Longer term trends in the markets and economy.

Extra details on what seems underappreciated or overhyped.

Link to some great explainers on the concepts.

**Everything as of 7/17/2025

Quarterly earnings announcements are like getting to watch MARCH MADNESS 4 times a year. It’s rapid fire and chaotic. It’s contained to a short period of time. Everyone thinks they know who the winners will be. Occasionally, you’ll see an amazing Cinderella story, and it’s definitely, not at all, not even a little bit an excuse for gambling or making prop bets on outcomes. That’d be ridiculous.

The analysts and traders who handicap…excuse me…analyze the upcoming earnings announcements use a lot of numbers, have a lot of confidence in their statements, and a believe women find talking about this kind of stuff attractive.

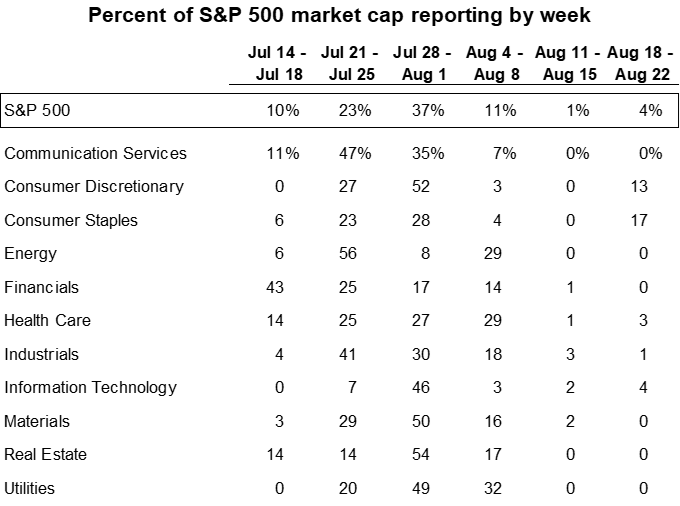

Every quarter, in a waterfall fashion over 6 weeks, every public company reveals the actual answer to the question: “How much money did we make?”. Analysts then huddle around the Bloomberg terminal like contestants from Family Feud hearing Steve Harvey reveal the answers after they’ve shouted out their guesses.

The Morning Line

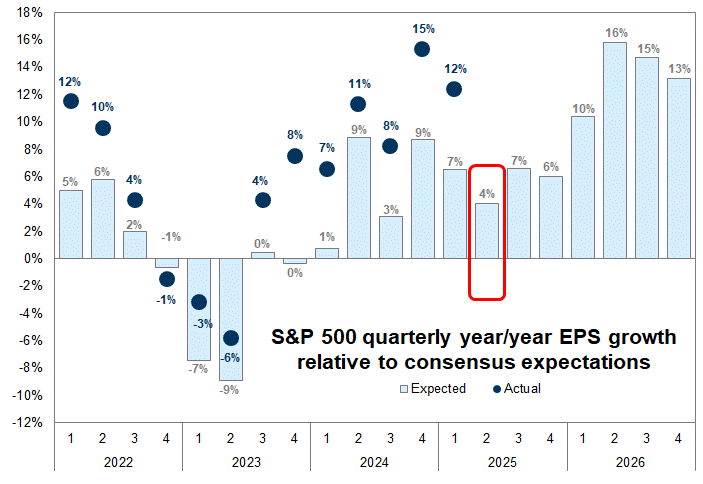

For this quarter, the “morning line” was quite a low bar to overcome making reports that much easier to surprise to the upside. Analysts forecast S&P 500 EPS YoY growth will decelerate to just 4%. Or in other words, the average earning per share for an S&P500 company will only grow by 4% since last year’s announcement.

You might notice a skew under promising and over delivering on results. You’re not wrong. Analysts and CEOs like to play a cover your ass strategy by being too conservative to the upside rather than disappointing markets and traders. Sadly, It usually works.

Results and Payouts

So far, so good. Big leading names like JPMorgan, Bank of America, TSMC and NFLX are all over performing

BofA reported an EPS beat (Q2 came at $0.89, vs est of $0.85),

Netflix posted second-quarter revenue growth of 16% citing “healthy” member growth and ad sales.

JPM Adjusted EPS $4.96, beating estimates of $4.47 per share and seeing gains in all lines of business.

Additionally, Technicals are a tailwind. With better results than forecast, we are likely to see the recent break out above the Pre-Liberation Day Tariff highs continue resulting in a summer rally towards 7000 on the S&P500 (12% gain) and 26,000 in the Nasdaq-100 by year end.

Interested in being on the Trader Dads Podcast in 2025? Shoot me an email! I’d love to have subscribers on to sit for a discussion

TRADERDADS MAILBAG

Thoughts? Questions? Comments?

Reach out! Maybe I’ll do a full post on the topic or as a Q&A

traderdads@substack.com